Dynacor Group Reports Quarterly Sales of $67.4 Million, a Net Income of $4.5 Million in Q2-2024 (US$0.12 or CA$0.16 Per Share) and a Record EBITDA of $8.3 Million

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240815408213/en/

(Graphic: Business Wire)

These documents have been filed electronically with SEDAR+ at www.sedarplus.com and will be available on the Corporation's website www.dynacor.com.

(All figures in this press release are in Ms of US$ unless stated otherwise. All amounts per share are in US$. All variance % are calculated from rounded figures. Some additions might be incorrect due to rounding).

Q2-2024 OVERVIEW AND HIGHLIGHTS

OVERVIEW

During Q2-2024, the

HIGHLIGHTS

Operational

- Ore volume supplied remained high. Total ore volume supplied reached 42,883 tonnes in Q2-2024 compared to 45,730 tonnes for the same period of last year;

- Higher volume processed. The Veta Dorada plant processed a volume of 42,935 tonnes of ore (472 tpd average) compared to 40,747 tonnes in Q2-2023 (448 tpd), a 5.4% increase;

- Gold production reduced due to lower grades of ore processed. In Q2-2024, gold equivalent production reached 28,364 AuEq ounces compared to 32,693 AuEq ounces in Q2-2023.

Financial

- Increases in gold prices from March and operational results positively impacted the Q2-2024 financial results.

-

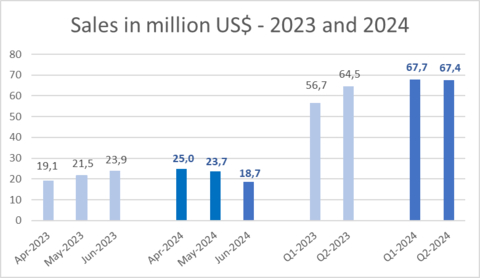

Increased Sales. Sales amounted to

$67.4 million in Q2-2024 compared to$64.5 million in Q2-2023, a 4.5% increase; -

Record gross operating margin of

$10.0 million (14.8% of sales) in Q2-2024, compared to$7.7 million (11.9% of sales) in Q2-2023; -

Increase of 33.9% in operating income. Operating income of

$7.5 million in Q2-2024 compared to$5.6 million in Q2-2023; -

Record cash gross operating margin of

$375 per AuEq ounce sold (1) compared to$256 in Q2-2023, a 46.5% increase; -

Record EBITDA

(2) of

$8.3 million , compared to$6.6 million in Q2-2023, a 25.8% increase; -

Increased cash flows. Cash flows from operating activities before change in working capital items of

$5.8 million ($0.16 per share) (3) compared to$5.2 million ($0.14 per share) in Q2-2023, a 11.5% increase; -

Strong net income.

Dynacor Group recorded a net income of$4.5 million in Q2-2024 (US$0.12 or CA$0.16 per share) similar to Q2-2023; -

Solid cash position. Cash on hand of

$34.7 million at the end of Q2-2024 compared to$22.5 million at year end 2023;

Return to Shareholders

-

Share buy-back. 37,200 common shares repurchased for

$0.1 million (CA$0.2 million) in Q2-2024, compared to 40,300 common shares for$0.1 million (CA$0.1 million) in Q2-2023; -

Increased dividends. A 16.7% monthly dividend increase is paid since

January 2024 . On an annual basis, the 2024 dividend will represent CA$0.14 per share or 2.7% dividend yield based on the current share price.

|

(1) |

Cash gross operating margin per AuEq ounce is in US$ and is calculated by subtracting the average cash cost of sale per equivalent ounces of Au from the average selling price per equivalent ounces of Au and is a non-IFRS financial performance measure with no standard definition under IFRS Accounting Standards. It is therefore possible that this measure could not be comparable with a similar measure of another company. |

|

|

(2) |

EBITDA: “Earnings before interest, taxes and depreciation” is a non-IFRS financial performance measure with no standard definition under IFRS Accounting Standards. It is therefore possible that this measure could not be comparable with a similar measure of another corporation. The Corporation uses this non-IFRS measure as an indicator of the cash generated by the operations and allows investor to compare the profitability of the Corporation with others by canceling effects of different assets basis, effects due to different tax structures as well as the effects of different capital structures. |

|

|

(3) |

Cash-flow per share is a non-IFRS financial performance measure with no standard definition under IFRS Accounting Standards. It is therefore possible that this measure could not be comparable with a similar measure of another corporation. The Corporation uses this non-IFRS measure which can also be helpful to investors as it provides a result which can be compared with the Corporation market share price. |

RESULTS FROM OPERATIONS

|

Unaudited Consolidated Statement of net income and comprehensive income |

||||||

|

|

||||||

|

|

|

Three-month periods

|

|

Six-month periods

|

||

|

(in $'000) (unaudited) |

|

2024 |

2023 |

|

2024 |

2023 |

|

|

|

|

|

|

|

|

|

Sales |

|

67,431 |

64,472 |

|

135,164 |

121,205 |

|

Cost of sales |

|

(57,437) |

(56,817) |

|

(116,022) |

(105,721) |

|

Gross operating margin |

|

9,994 |

7,655 |

|

19,142 |

15,484 |

|

General and administrative expenses |

|

(2,127) |

(1,813) |

|

(3,831) |

(3,366) |

|

Other projects expenses |

|

(327) |

(202) |

|

(541) |

(426) |

|

Operating income |

|

7,540 |

5,640 |

|

14,770 |

11,692 |

|

Financial income net of expenses |

|

168 |

163 |

|

339 |

316 |

|

Foreign exchange gain (loss) |

|

(125) |

161 |

|

(184) |

211 |

|

Income before income taxes |

|

7,583 |

5,964 |

|

14,925 |

12,219 |

|

Current income tax expense |

|

(2,841) |

(1,828) |

|

(5,418) |

(3,807) |

|

Deferred income tax (expense) recovery |

|

(241) |

343 |

|

(225) |

534 |

|

Net income and comprehensive income |

|

4,501 |

4,479 |

|

9,282 |

8,946 |

|

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

Total sales amounted to

Cumulative sales increased by

The gross operating margin increased by

General and administrative expenses amounted to

As budgeted, other projects represent the expenses incurred by the Corporation to duplicate its unique business model in other jurisdictions.

The Q2-2024 net income was also affected by the recording of a

|

Reconciliation of non-IFRS measures |

||||||

|

(in $’000) (unaudited) |

|

Three-month periods

|

|

Six-month periods

|

||

|

|

|

2024 |

2023 |

|

2024 |

2023 |

|

Reconciliation of net income and comprehensive income to EBITDA |

|

|

|

|

|

|

|

Net income and comprehensive income |

|

4,501 |

4,479 |

|

9,282 |

8,946 |

|

Income tax expenses (current and deferred) |

|

3,082 |

1,485 |

|

5,643 |

3,273 |

|

Financial income net of expenses |

|

(186) |

(170) |

|

(357) |

(323) |

|

Depreciation |

|

911 |

833 |

|

1,796 |

1,617 |

|

EBITDA |

|

8,308 |

6,627 |

|

16,364 |

13,513 |

CONSOLIDATED CASH FLOW FROM OPERATING, INVESTING AND FINANCING ACTIVITIES AND WORKING CAPITAL AND LIQUIDITY

Operating activities

During Q2-2024, the cash flow from operations, before changes in working capital items, amounted to

During Q2-2024, total cash from operating activities amounted to

Investing activities

During the three-month period ended

Financing activities

In Q2-2024, monthly dividends totaling CA$0.035 per share were disbursed for a total consideration of

In Q2-2024, 37,200 common shares were repurchased under the Corporation normal course issuer bid share buyback program for a total cash consideration of

Working capital and liquidity

As at

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at

|

(in $'000) (unaudited) |

|

As at

|

As at

|

|

|

|

|

2024 |

2023 |

|

|

Cash |

|

34,734 |

22,481 |

|

|

Accounts receivable |

|

9,371 |

13,328 |

|

|

Inventories |

|

25,612 |

31,925 |

|

|

Prepaid |

|

635 |

277 |

|

|

Property, plant and equipment |

|

25,181 |

24,590 |

|

|

Right-of-use assets |

|

569 |

613 |

|

|

Exploration and evaluation assets |

|

18,566 |

18,566 |

|

|

Other non-current assets |

|

54 |

- |

|

|

Total assets |

|

114,722 |

111,780 |

|

|

|

|

|

|

|

|

Trade and other payables |

|

12,689 |

15,357 |

|

|

Current tax liabilities |

|

2,369 |

1,799 |

|

|

Asset retirement obligations |

|

3,768 |

3,724 |

|

|

Deferred tax liabilities |

|

902 |

677 |

|

|

Lease liabilities |

|

586 |

636 |

|

|

Shareholders' equity |

|

94,408 |

89,587 |

|

|

Total liabilities and equity |

|

114,722 |

111,780 |

|

FOLLOW-UP OUTLOOK 2024

Ore processing

For 2024, the Corporation forecasted sales (1) ranging between

|

(1) |

Using a market gold price ranging between |

Capex

ABOUT

The corporation intends to expand its processing operations in other jurisdictions as well.

FORWARD-LOOKING INFORMATION

Certain statements in the preceding may constitute forward-looking statements, which involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of

Shares Outstanding: 36,431,706

Website: http://www.dynacor.com

Twitter: http://twitter.com/DynacorGold

View source version on businesswire.com: https://www.businesswire.com/news/home/20240815408213/en/

For more information, please contact:

Director, Shareholder Relations

T: 514-393-9000 #230

E: investors@dynacor.com

Source: