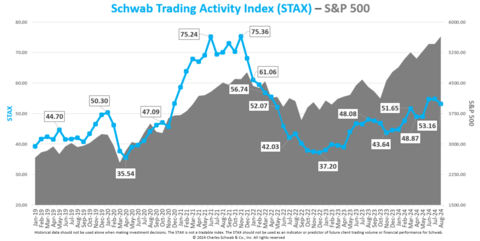

Schwab Trading Activity Index™: Score Remains at Moderate Levels Despite Dip in August

Schwab clients were net sellers of equities overall and across the Communication Services, Health Care and Information Technology sectors in August; they net bought Consumer Discretionary and Energy

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240909081610/en/

Schwab Trading Activity Index vs. S&P 500 (Graphic:

The reading for the five-week period ending

“Schwab clients appeared to rotate out of equities and into fixed income securities as a means of de-risking, which pushed the overall STAX score lower this month,” said

Volatility in equity markets persisted throughout the August STAX period. However, major indices did notch multi-day winning streaks, and the Dow Jones Industrial Average made a new high of 41,585.21 on the last day of the period,

On

Both the Consumer Price Index (CPI) and Producer Price Index (PPI) came in just below expectations at 2.9% (for the trailing 12 months) and 0.1%, respectively. Finally, Q2 Gross Domestic Product (GDP) estimates were raised to three percent versus real Q1 GDP of 1.4%; as was reported last period, the drivers are increased consumer spending and increases in business and inventory investments.

The CBOE Volatility Index (VIX) did experience another 50% spike early in the August STAX period, but then moderated, closing 9.82% lower at 14.78. The 10-year

Popular names bought by Schwab clients during the period included:

- NVIDIA Corp. (NVDA)

- Amazon.com Inc. (AMZN)

- Intel Corp. (INTC)

- Microsoft Corp. (MSFT)

- Advanced Micro Devices Inc. (AMD)

Names net sold by Schwab clients during the period included:

- Meta Platforms Inc. (META)

- Apple Inc. (AAPL)

- Starbucks Corp. (SBUX)

- PayPal Holdings Inc. (PYPL)

- Palo Alto Networks Inc. (PANW)

About the STAX

The STAX value is calculated based on a complex proprietary formula. Each month, Schwab pulls a sample from its client base of millions of funded accounts, which includes accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly STAX.

For more information on the Schwab Trading Activity Index, please visit www.schwab.com/investment-research/stax. Additionally, Schwab clients can chart the STAX using the symbol $STAX in either the thinkorswim® or thinkorswim Mobile platforms.

Investing involves risk, including loss of principal. Past performance is no guarantee of future results.

Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The STAX is not a tradable index. The STAX should not be used as an indicator or predictor of future client trading volume or financial performance for Schwab.

About

At Charles Schwab, we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at aboutschwab.com. Follow us on X, Facebook, YouTube, and LinkedIn.

0924-REDG

View source version on businesswire.com: https://www.businesswire.com/news/home/20240909081610/en/

At the Company

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com

Source: