OUTCROP SILVER REPORTS ADDITIONAL DRILL RESULTS FROM THE JIMENEZ TARGET AT SANTA ANA

Drilling Highlights

-

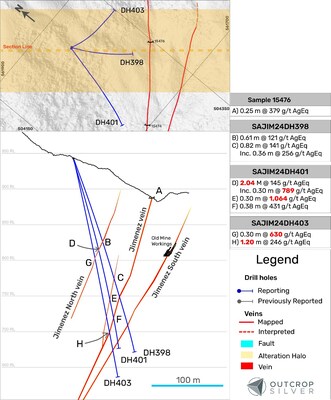

DH401 intercepted 0.32 metres at 1,288 grams per tonne of silver equivalent in Jimenez vein, as part of the 3.58 metres vein intercept at 131 grams per tonne of silver equivalent.

-

The newly discovered

Jimenez North vein returned 0.30 metres at 789 grams per tonne of silver equivalent, included in a 2.04 metres intercept at 145 grams per tonne of silver equivalent from hole DH401 (Table 1).

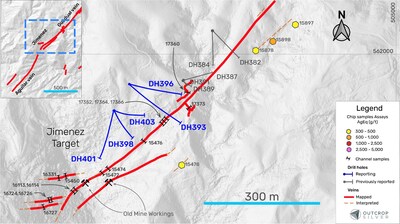

- Drilling at the Jimenez target has confirmed vein continuity along 500 metres of strike and 200 metres down dip (Figure 1 and Figure 2).

"Overall, these results confirm high-grade silver and gold mineralization at Jimenez, with several veins showing significant exploration potential based on their width. The intercepts highlight both narrow high-grade zones and broader zones of mineralization, contributing to the resource expansion potential in this vein system," comments

The Jimenez target is comprised of parallel and subparallel veins (Figure 1), forming a structurally controlled and complex vein system that extends nearly 500 metres along strike. The historical workings, including colonial-era adits, indicate long-term mining activity along the Jimenez vein system The mineralization is hosted within quartz veins and is associated with sulfides, including argentite (silver sulfide), which is typical of the high-grade ore shoots found throughout the Santa Ana project.

|

Target |

Hole ID |

From |

To |

Interval |

Estimated |

Au g/t |

Ag g/t |

AgEq g/t |

Vein |

|

Jimenez |

DH393 |

92.27 |

92.57 |

0.30 |

0.29 |

0.99 |

81 |

155 |

Vein |

|

DH396 |

110.42 |

110.72 |

0.30 |

0.23 |

2.37 |

266 |

444 |

Vein |

|

|

DH396 |

224.14 |

224.47 |

0.33 |

0.21 |

1.23 |

19 |

111 |

Jimenez |

|

|

DH398 |

150.42 |

151.03 |

0.61 |

0.41 |

0.43 |

89 |

121 |

|

|

|

DH398 |

179.52 |

180.34 |

0.82 |

0.55 |

0.67 |

90 |

141 |

Vein |

|

|

Including |

179.52 |

179.88 |

0.36 |

0.24 |

1.24 |

163 |

256 |

||

|

DH398 |

204.60 |

205.58 |

0.98 |

0.52 |

0.15 |

79 |

91 |

Jimenez |

|

|

DH401 |

170.44 |

180.66 |

2.04 |

1.30 |

0.30 |

122 |

145 |

|

|

|

Including |

180.36 |

180.66 |

0.30 |

0.19 |

1.28 |

692 |

789 |

||

|

DH401 |

226.20 |

226.50 |

0.30 |

0.15 |

3.24 |

821 |

1,064 |

Vein |

|

|

DH401 |

278.10 |

281.68 |

3.58 |

2.09 |

0.22 |

115 |

131 |

Jimenez |

|

|

Including |

281.36 |

281.68 |

0.32 |

0.19 |

1.55 |

1,171 |

1,288 |

||

|

DH403 |

196.16 |

196.46 |

0.30 |

0.16 |

1.17 |

543 |

630 |

|

|

|

DH403 |

228.75 |

229.95 |

1.20 |

0.68 |

0.35 |

220 |

246 |

Jimenez |

|

Table 1. Drill hole assay results reported in this release. Silver equivalent (AgEq) was calculated using the prices, recovery and grades of each element using the formula given in the silver equivalent note |

The drill program at the Jimenez target is focused on testing both the depth and lateral extensions of the vein, with the objective of expanding the resource potential. Confirmed high-grade zones and continuity of mineralization at depth strengthen the case for resource expansion, particularly given the vein's width. Promising results from the Jimenez North vein, which runs parallel to the Jimenez vein, highlight the potential for wider and high-grade vein intercepts.

|

Sample |

Easting |

Northing |

Elevation |

Sample |

Width |

Au g/t |

Ag g/t |

AgEq g/t |

Release Date |

|

15450 |

504144.20 |

561684.34 |

797.32 |

UG Channel |

0.30 |

6.22 |

2,436 |

2,903 |

|

|

15472 |

504238.88 |

561692.22 |

815.57 |

UG Channel |

0.50 |

4.51 |

851 |

1,189 |

|

|

15474 |

504254.61 |

561703.24 |

827.98 |

UG Channel |

0.60 |

3.36 |

867 |

1,119 |

|

|

15476 |

504346.95 |

561774.79 |

890.52 |

UG Channel |

0.25 |

1.17 |

291 |

379 |

|

|

15478 |

504444.00 |

561713.00 |

929.50 |

Chip |

|

1.22 |

294 |

385 |

|

|

16113 |

504164.51 |

561645.05 |

796.04 |

Channel |

0.20 |

2.06 |

643 |

798 |

|

|

16114 |

504167.96 |

561647.93 |

791.06 |

Channel |

0.55 |

1.39 |

320 |

425 |

|

|

16724 |

504101.67 |

561621.71 |

901.55 |

Channel |

0.30 |

6.36 |

1,449 |

1,926 |

Current Release |

|

16726 |

504101.79 |

561619.02 |

899.00 |

Channel |

0.60 |

1.94 |

324 |

470 |

Current Release |

|

16727 |

504087.00 |

561604.00 |

888.00 |

Channel |

0.70 |

2.47 |

618 |

804 |

Current Release |

|

17352 |

504405.09 |

561833.03 |

919.13 |

UG Channel |

0.90 |

1.35 |

675 |

777 |

|

|

17360 |

504459.62 |

561901.32 |

976.00 |

Channel |

0.40 |

2.67 |

229 |

430 |

|

|

17364 |

504396.34 |

561823.42 |

919.13 |

UG Channel |

0.45 |

1.48 |

350 |

462 |

|

|

17366 |

504398.48 |

561825.97 |

919.13 |

UG Channel |

0.50 |

2.28 |

768 |

939 |

|

|

17373 |

504464.00 |

561860.98 |

969.00 |

Channel |

0.45 |

3.93 |

384 |

679 |

|

|

Table 2. Channel and Chip sample results in the Jimenez target from the Target Generation program previously reported and referred to in Figure 1 (see News Releases dated

|

|

Hole ID |

Easting |

Northing |

Elevation |

Hole Depth |

Azimuth |

Dip |

Drill Hole Code |

|

DH382 |

504525.146 |

562060.844 |

1000.301 |

140.20 |

136 |

-45 |

SAGU24DH382 |

|

DH384 |

504523.853 |

562060.777 |

1001.020 |

190.19 |

179 |

-61 |

SAGU24DH384 |

|

DH387 |

504449.408 |

561932.800 |

982.022 |

108.50 |

78 |

-45 |

SAGU24DH387 |

|

DH389 |

504448.107 |

561931.265 |

982.102 |

149.04 |

139 |

-80 |

SAGU24DH389 |

|

DH391 |

504448.088 |

561931.288 |

982.089 |

240.48 |

139 |

-87 |

SAJIM24DH391 |

|

DH393 |

504308.823 |

561922.145 |

990.049 |

300.16 |

130 |

-55 |

SAJIM24DH393 |

|

DH396 |

504309.224 |

561922.818 |

990.370 |

274.01 |

106 |

-60 |

SAJIM24DH396 |

|

DH398 |

504270.119 |

561853.885 |

942.758 |

285.26 |

154 |

-69 |

SAJIM24DH398 |

|

DH401 |

504268.771 |

561853.660 |

942.951 |

320.49 |

192 |

-62 |

SAJIM24DH401 |

|

DH403 |

504270.455 |

561854.316 |

942.902 |

317.29 |

116 |

-76 |

SAJIM24DH403 |

|

Table 3. Collar and survey table for drill holes reported and referred to in this release. All coordinates are UTM system, Zone 18N, and WGS84 projection. |

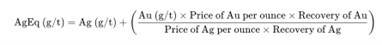

Silver equivalent

Metal prices used for equivalent calculations were

Metallurgical recoveries based on Outcrop Silver's Metallurgical test work are 97% for gold and 93% for silver (see NR from

QA/QC

For exploration core drilling, Outcrop Silver applied its standard protocols for sampling and assay. HQ-NTW core is sawn with one-half shipped. Core samples were sent to either ALS, Actlabs or SGS in

Qualified Person

About Santa Ana

The 100% owned Santa Ana project covers 27,000 hectares within the

Santa Ana's maiden resource estimate, detailed in the NI 43-101 Technical Report titled "Santa Ana Property Mineral Resource Estimate," dated

The 2024 drilling campaign aims to extend known mineralization and test new high-potential areas along the permitted section of the project's extensive 30 kilometres of mineralized trend. This year's exploration strategy aims to demonstrate a clear pathway to substantially expand the resource. These efforts underscore the scalability of Santa Ana and its potential for substantial resource growth, positioning the project to develop into a high-grade, economically viable, and environmentally responsible silver mine.

About Outcrop Silver

Outcrop Silver is a leading explorer and developer focused on advancing its flagship Santa Ana high-grade silver project in

At the core of our operations is a commitment to responsible mining practices and community engagement, underscoring our approach to sustainable development. Our expertise in navigating complex geological and market conditions enables us to consistently identify and capitalize on opportunities to enhance shareholder value. With a deep understanding of the Colombian mining landscape and a track record of successful exploration, Outcrop Silver is poised to transform the Santa Ana project into a significant silver producer, contributing positively to the local economy and setting new standards in the mining industry.

ON BEHALF OF THE BOARD OF DIRECTORS

Chief Executive Officer

+1 604 638 2545

harris@outcropsilver.com

www.outcropsilver.com

Vice President of Investor Relations

+1 778 783 2818

li@outcropsilver.com

Neither the

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "potential," "we believe," or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Outcrop to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including: the receipt of all necessary regulatory approvals, capital expenditures and other costs, financing and additional capital requirements, completion of due diligence, general economic, market and business conditions, new legislation, uncertainties resulting from potential delays or changes in plans, political uncertainties, and the state of the securities markets generally. Although management of Outcrop have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Outcrop will not update any forward-looking statements or forward-looking information that are incorporated by reference.

SOURCE